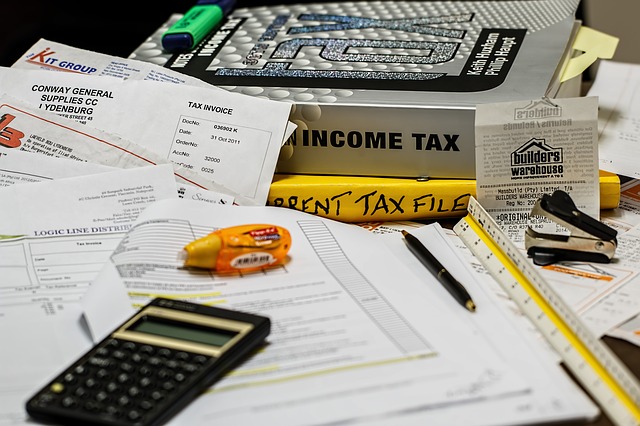

Taxes: The Expected & Unexpected

While our obligation to pay state and federal taxes every year is undeniable, the amount we owe can vary based on our family and employment situation. Successful, beneficial tax filing requires a basic level of preparation on your part. Before you file, make sure you have the following information on-hand:

- Your Social Security Number, as well as the SSN of your spouse and children.

- W-2 forms from employers

- 1099 forms for any independent contractor work

- Additional information such as unemployment, rental property and business income, and state and federal refunds from the previous year.

Unfortunately, even if we think we know what to expect on our tax bill, it is not uncommon for people to discover they owe more than they anticipated. Here are four aspects of filing that you may not have been aware of, and four steps you can take to ensure your finances are ready for these moments:

- Dependents: You may have heard dependents, such as your children, can qualify you for tax credits. But you may not be aware that relatives who have lived with you for the year, such as an elderly parent, also may qualify as a dependent. Know the rules so you can experience the benefit.

- Taxes Don’t Go Away with Time: Even if you are no longer in the workforce, you still may owe the government taxes; withdrawals from retirement savings and your Social Security benefits may be subject to taxation which will vary depending on the circumstances. Compensate by pushing yourself to save early and often in the many years leading up to your retirement.

- The Cost of Independence: If you work as an independent contractor, it is important to note that you are generally supposed to pay federal income tax quarterly based on what you expect to make for the year. While it can be difficult to anticipate just how much you will owe after your business-related deductions; push yourself to keep a healthy savings throughout the year, to cover an unexpected tax bill.

Taxes can be a painful expense if you have not already taken steps to create a cushion in anticipation of the government’s bill. If you stay organized, you can stay stable in the face of this expected but varying cost.

To learn more ways to improve your professional and financial life, including embarking on an exciting second career, visit the Syncis blog at https://www.syncis.com/blog/.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.