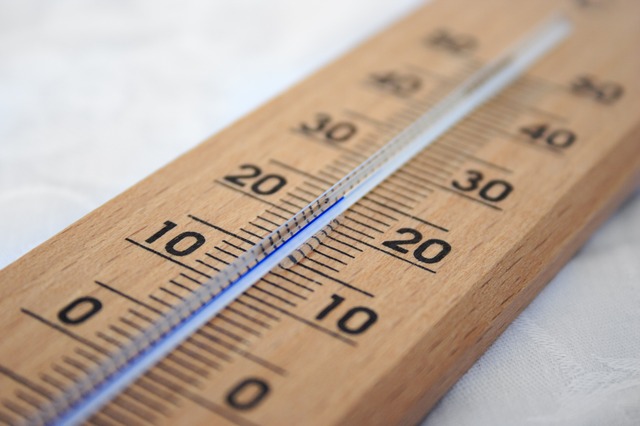

Take Your Financial Temperature

When was the last time you took a clear, comprehensive look at your financial standing? An assessment of your financial health can help you determine if you are finally financially stable, are ready to make a major purchase, or need to make a few adjustments to your financial strategy.

Three helpful financial barometers include your credit score, debt-to-income ratio, and your emergency fund.

Credit Score: Scores range from 300 to 850. Credit scores from 670 to 739 are typically considered good, scores above 740 are very good, and scores over 800 are excellent. Credit scores give lenders a sense of your past credit behaviors, such as the timeliness of your payments. If your score is low, you are less likely to be approved for a loan or new credit card. In the event you are approved, you may be subjected to higher interest rates. If your credit score is below good, make a plan to reduce your debt, submit payments on time, and halt your borrowing until you see an improvement in your score. While it will take time and daily effort, many people are able to raise their scores within six to twelve months.

Debt-to-Income Ratio: Lenders will also assess your debt-to-income ratio when determining your financial worthiness. This ratio represents the amount of debt you are in compared to the amount of income you earn each month. Individuals with a ratio of 20% or below are considered financially healthy. If your debt-to-income ratio is 36% or higher, consider focusing on improving this ratio for the sake of your future creditworthiness.

Emergency Fund: If your car needed an emergency repair, or you were let go from your job tomorrow, would you be able to cover your expenses for the month? If the answer is no, you may be financially at risk. An emergency fund is a vital, valuable building block in your financial foundation. Save money each week until you have enough set aside to cover one month of unemployment. This financial safety net will help you avoid future headaches and help you continue toward your goals without interruptions.

Would you like to learn more? To gain additional insight about your financial temperature, visit us at www.syncis.com/blog today.