How to Overcome Your Biggest Roadblock to Financial Success

Before we achieve financial security, we need to master this simple concept: Don’t spend more money than you make. Even the wealthiest people in society understand the importance of frugality.

If frugal living sounds like a barebones nightmare, or you simply feel like you can’t get your spending under control, these six tips can help you live comfortably within your means:

- The Right Mindset: Practice “intelligent spending.” Ideally, you’ll spend less than a third of your total income on regular household expenses, and you’ll have 20% left to put toward financial goals. Think about gaining money, not spending it. And find friends who think along the same lines!

- Assess Yourself: Track your spending throughout the month. After you have a sense of your spending habits, make a budget based on the above “intelligent spending” guidelines.

- Renegotiate Recurring Bills: Call your service providers and explain you are budgeting your spending. If you mention you plan on switching to a more affordable competitor, you might find your provider wants to offer you a better price!

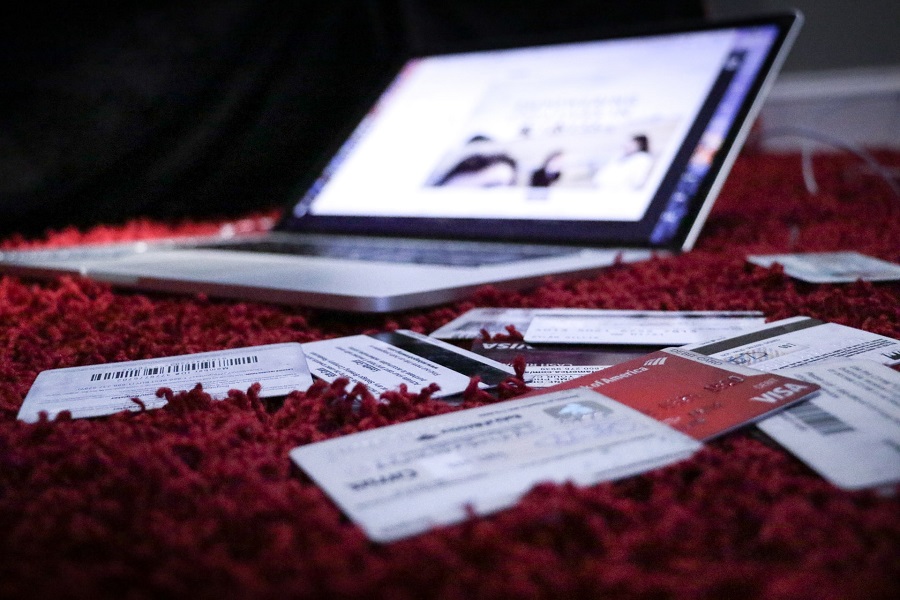

- Don’t Incur More Debt: Unless you can afford to pay your credit card balances off completely at the end of each month, leave the credit cards at home and delete saved payment information where you make your online purchases.

- Cut Costs: Resist the urge to splurge; buy only what you need. You don’t need to eliminate all luxuries, but do practice moderation. Buy generic where you can, cut subscriptions, and keep close track of your bills (mistakes happen!).

- Do It Yourself: Could you make or grow what you need at home? More and more people are cutting costs by doing things like making their own detergent, growing their own food, and preparing meals in the kitchen rather than eating out.

Once your spending is in balance, you can take your next steps toward financial security!