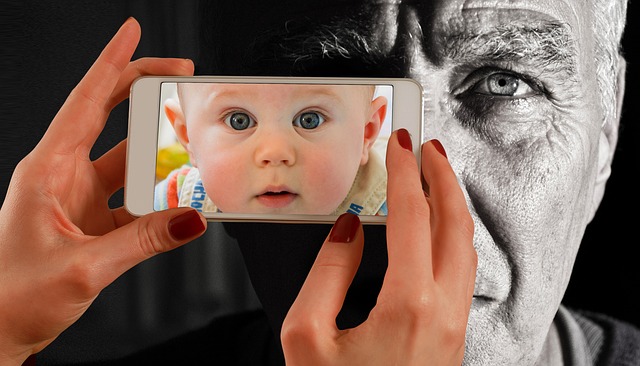

Financial Considerations by Age

As we age, we may find we need to shift our financial focus to keep our long-term plans on-track. Here are some general financial-mindset guidelines for each decade of your life:

- Good Habits in Your 20s: This is when you need to get into good financial habits. Learn how to budget, and stick to it. Open a savings account and automate your transfers. Resist the temptation to spend more than you make and accrue credit card debt.

- Keep Balanced in Your 30s: Don’t let a higher income distract you from the need to save! Consider starting a college-fund for your children, or making an extra mortgage payment each year to reduce your repayment period. Retirement and other long-term financial goals may seem far off, but unless you get adequately insured, you risk offsetting your progress with a single accident.

- Reflect in Your 40s: This is a good time to reassess your financial plan. Can you cut back on “wants” and put more into savings? Consider forming a plan to help you pay off your mortgage before you retire. Keep in mind the quality of life you want in retirement.

- Legacy in Your 50s: Make sure you have eliminated your debts, which can get in the way of your retirement. You also want to be sure you’ve taken steps to preserve your legacy by being insured, as well as by protecting your estate with a will or trust.

- Active Retirement in Your 60s: As you approach retirement, even though this is a well-earned time of rest, you will still want to manage your funds diligently, otherwise you may suddenly find you cannot afford your preferred lifestyle.

It’s never too late to start smart money practices! If you want to learn more about how to get on track for your age, visit Syncis at http://www.syncis.com/financial-concepts/