What Is Inflation?

The simplest way to think of Inflation is as an increase in the price you pay for goods and services. In other words, a decline in your purchasing power.

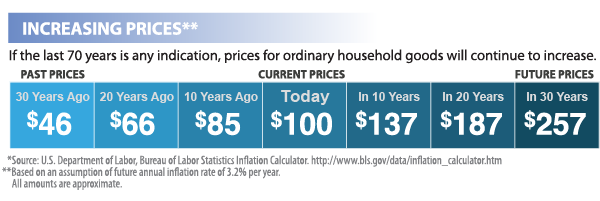

Every year, the United States Department of Labor takes prices of a variety of products and services. This information is used by many economists to calculate an average inflation rate. The average annual inflation rate since 1913 has been 3.2% per year.*

This means, 10/20/30 years from now, ordinary goods will likely cost more and you will be able to buy less with the same amount of money as today.

What Does This Mean For Me?

Based on historical averages, your buying power is going to decrease an average of over 3% every year. That means when you plan for the future, you have to take into account that your money in the future will probably buy less than it does now. In other words, in the future, you might need more money to buy the same things as you can today with less money.

What Can I Do?

One thing to consider when investing or accumulating assets is to think about whether the interest you are earning is going to be higher than the rate of inflation over the same amount of time. If your rate of return is lower than inflation, you may not really be “growing” your money.